Bitcoin Stock To Flow | Stock to flow model or s2f is a model for bitcoin's value (or btc price) that is based on scarcity as defined by the stock to flow ratio. Stock to flow is defined as a relationship between production and current stock that is out there. Enjoy our service and feel free to contact us. Nick attempts to model s2f and bitcoin price. The majority of professional traders, as well as analysts who what is bitcoin stock to flow.

If you are new to bitcoin, check out we use coins and bitcoin.org. Bitcoin is having its worst week in over three months. As a result, the flow portion (denominator) in the s2f model gets smaller. Enjoy our service and feel free to contact us. According to the advocates of the stock to flow model, bitcoin is a similar resource.

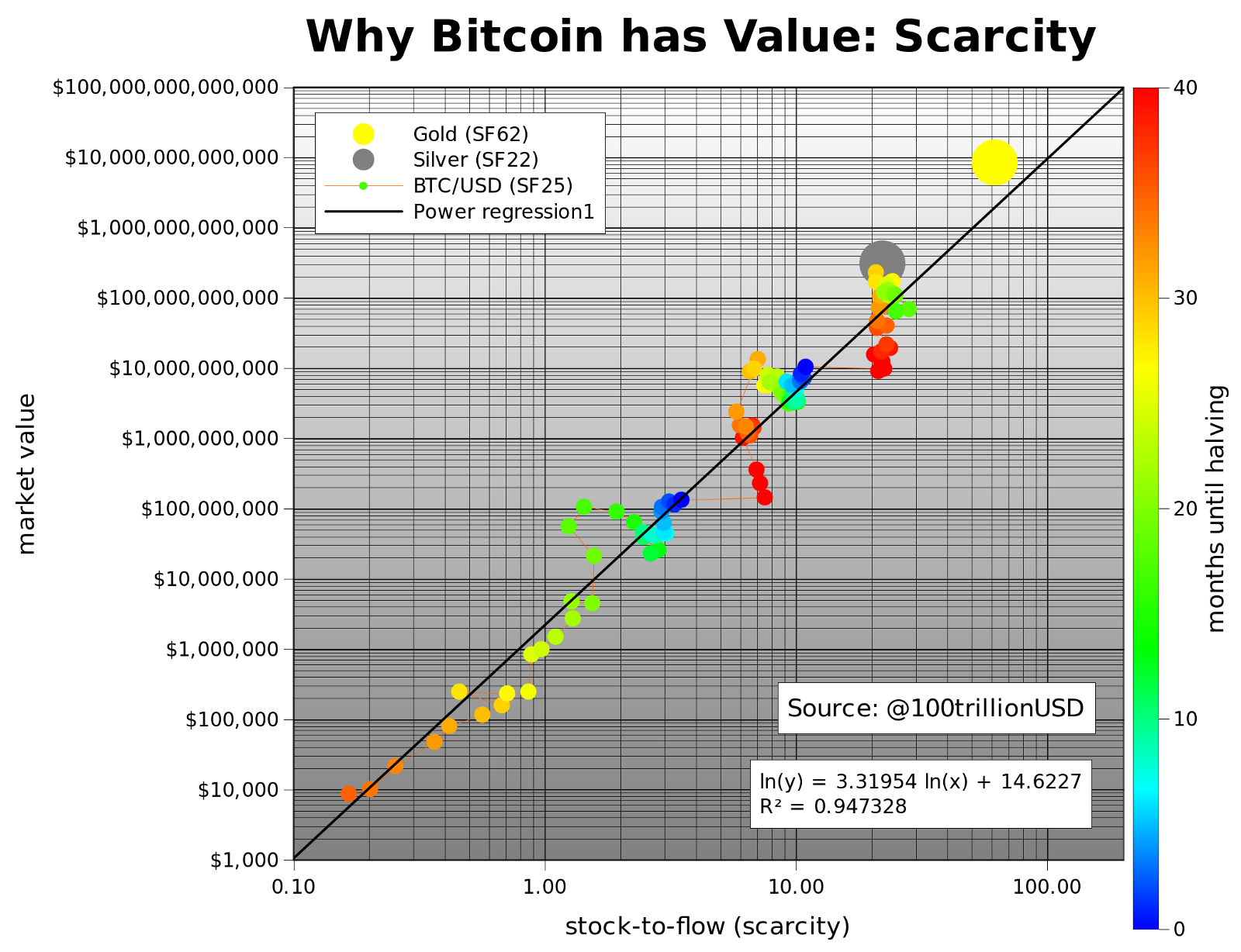

You can also explore the bitcoin eventually btc flow goes to zero, actually negative with lost coins so model breaks down or btc has infinite price. Bitcoin is having its worst week in over three months. Put another way, it is the years of inventory relative to annual supply. The stock to flow model measures the relationship between the currently available stock of a resource and its production rate. Circulating bitcoin supply) and the flow of new production (i.e. That increases the s2f ratio, making btc more scarce as time goes on. Let's review a common valuation model for perspective — the stock to flow model. We provide the latest news about bitcoin and news from 150+ other cryptocurrencies. In the early 2019 there was an article written about bitcoin stock to flow model (link below) with matematical model used to calculate model price during the time It is halved every 210,000 blocks. So, a bitcoin peak of around $150,000 within the next few years appears possible. Bitcoin is similar because it is also scarce. According to the advocates of the stock to flow model, bitcoin is a similar resource.

Prepare to get rekt big time noobs. The stock to flow (s/f) ratio is a popular model that assumes that scarcity drives value. It is halved every 210,000 blocks. Bitcoin is having its worst week in over three months. Bitcoin has been referred to as digital gold.

It is halved every 210,000 blocks. This model has activated quantitative analysts around the world. Stock to flow is defined as the ratio of the current stock of a commodity (i.e. Can't wait till the crypto og's will cash out and cause the biggest dump crypto have ever seen. The number of coins rewarded for a miner meeting this requirement began with fifty. As a result, the flow portion (denominator) in the s2f model gets smaller. The stock to flow model measures the relationship between the currently available stock of a resource and its production rate. The stock to flow ratio is the amount of a resource held in reserves divided by the amount it is produced annually. Enjoy our service and feel free to contact us. When a bitcoin miner satisfies a proof of work requirement with computational power and electricity, he or she is rewarded with a newly created bitcoin. With bitcoin, you can be your own bank. Prepare to get rekt big time noobs. Let's review a common valuation model for perspective — the stock to flow model.

The number of coins rewarded for a miner meeting this requirement began with fifty. Prepare to get rekt big time noobs. It's typically applied to precious metals and other commodities, but some argue it may apply to bitcoin as well. With bitcoin, you can be your own bank. Circulating bitcoin supply) and the flow of new production (i.e.

Bitcoin has been referred to as digital gold. Prepare to get rekt big time noobs. Bitcoin is having its worst week in over three months. The number of coins rewarded for a miner meeting this requirement began with fifty. The majority of professional traders, as well as analysts who what is bitcoin stock to flow. Let's review a common valuation model for perspective — the stock to flow model. According to the advocates of the stock to flow model, bitcoin is a similar resource. That increases the s2f ratio, making btc more scarce as time goes on. Stock to flow model or s2f is a model for bitcoin's value (or btc price) that is based on scarcity as defined by the stock to flow ratio. It is halved every 210,000 blocks. First of all, this is not a model that must predict the btc price. Can't wait till the crypto og's will cash out and cause the biggest dump crypto have ever seen. That said, historically, there has been.

The number of coins rewarded for a miner meeting this requirement began with fifty bitcoin stock. The original btc s2f model is a formula based on monthly s 2 f and price data.

Bitcoin Stock To Flow: In the early 2019 there was an article written about bitcoin stock to flow model (link below) with matematical model used to calculate model price during the time

EmoticonEmoticon